Communicating the Value of Design Practices

Prototyping design-driven initiatives at Northwestern Mutual

2022

Service Design

About

Northwestern Mutual (NWM), a Fortune 100 company renowned for its financial strength, is a financial services mutual organization serving families and businesses across the United States. With a diverse range of offerings that includes life insurance, annuities, investments, and financial planning, Northwestern Mutual has cultivated a robust market presence. Their strong risk-averse culture has allowed them to thrive on traditional operating models, confidently navigating a landscape where others might falter. Yet, to ensure sustained long-term growth, Northwestern Mutual recognizes the imperative to define what innovation means within its ranks and to establish the necessary processes that will facilitate transformation.

In this project, my team—Adelyn Soetyono, Jorge Martinez Arana, Ran Kanoko, and Naomi Ito, worked with influential stakeholders at Northwestern Mutual with the goal of communicating the impact of design capabilities for Northwestern. This initiative was a key component of the Institute of Design’s Innovation Methods course, led by Prof. Jeremy Alexis.

Objectives

- Facilitate a design sprint with a challenge currently faced by NWM.

- Involve NWM stakeholders as passive team members.

- Deliver tangible outcomes from designing the design sprint, and provide evidence of the work with documentation of the process.

Planning

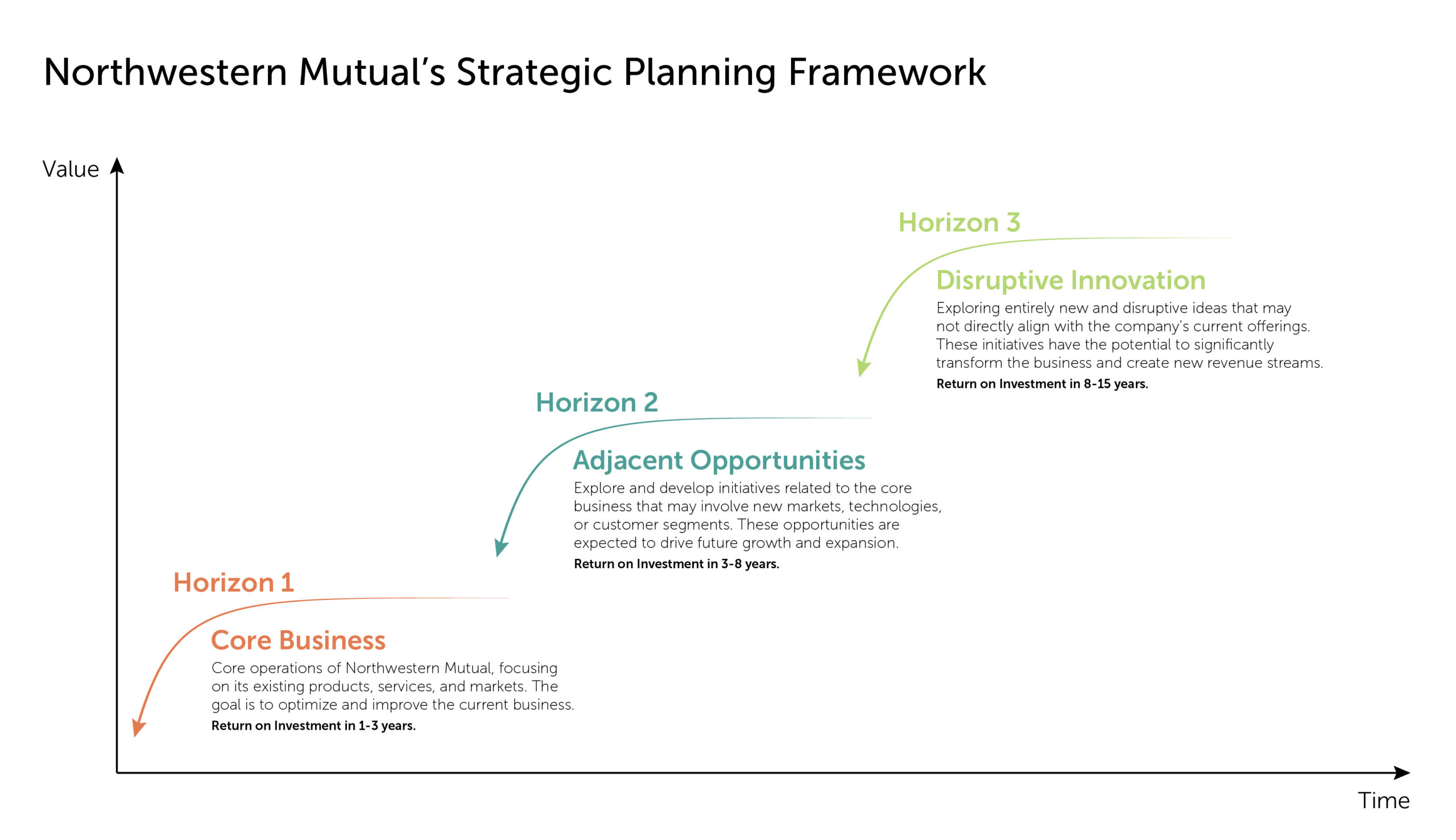

NWM’s Strategic Planning Framework is based on McKinsey’s Three Horizon Model:

Challenge

We collectively chose a challenge that was relevant to the ongoing efforts at NWM to demonstrate real-time differences:

How might Northwestern Mutual address unmet user needs in the Client–Financial Representative(FR) experience enabled by new technologies in horizons 2 and 3?

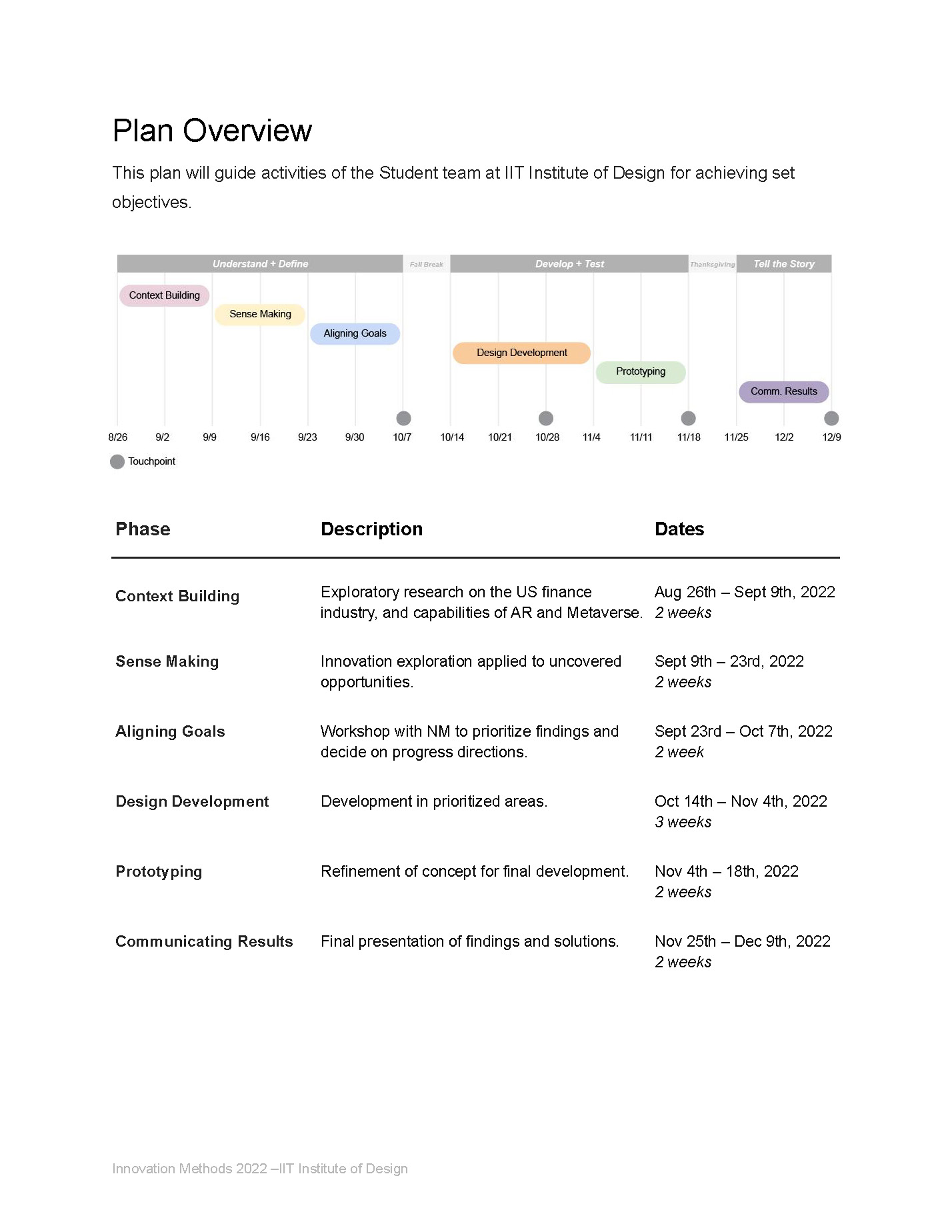

Research Plan

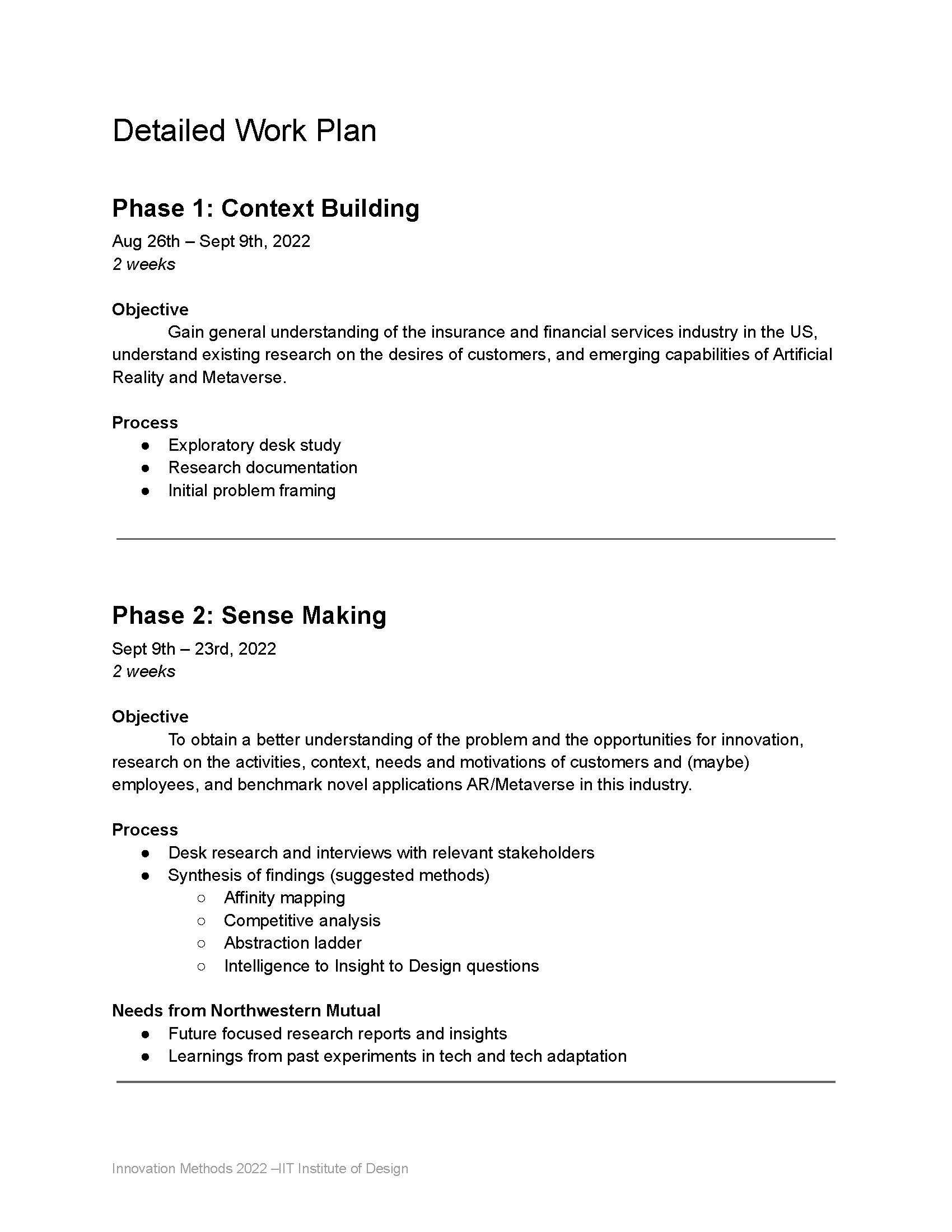

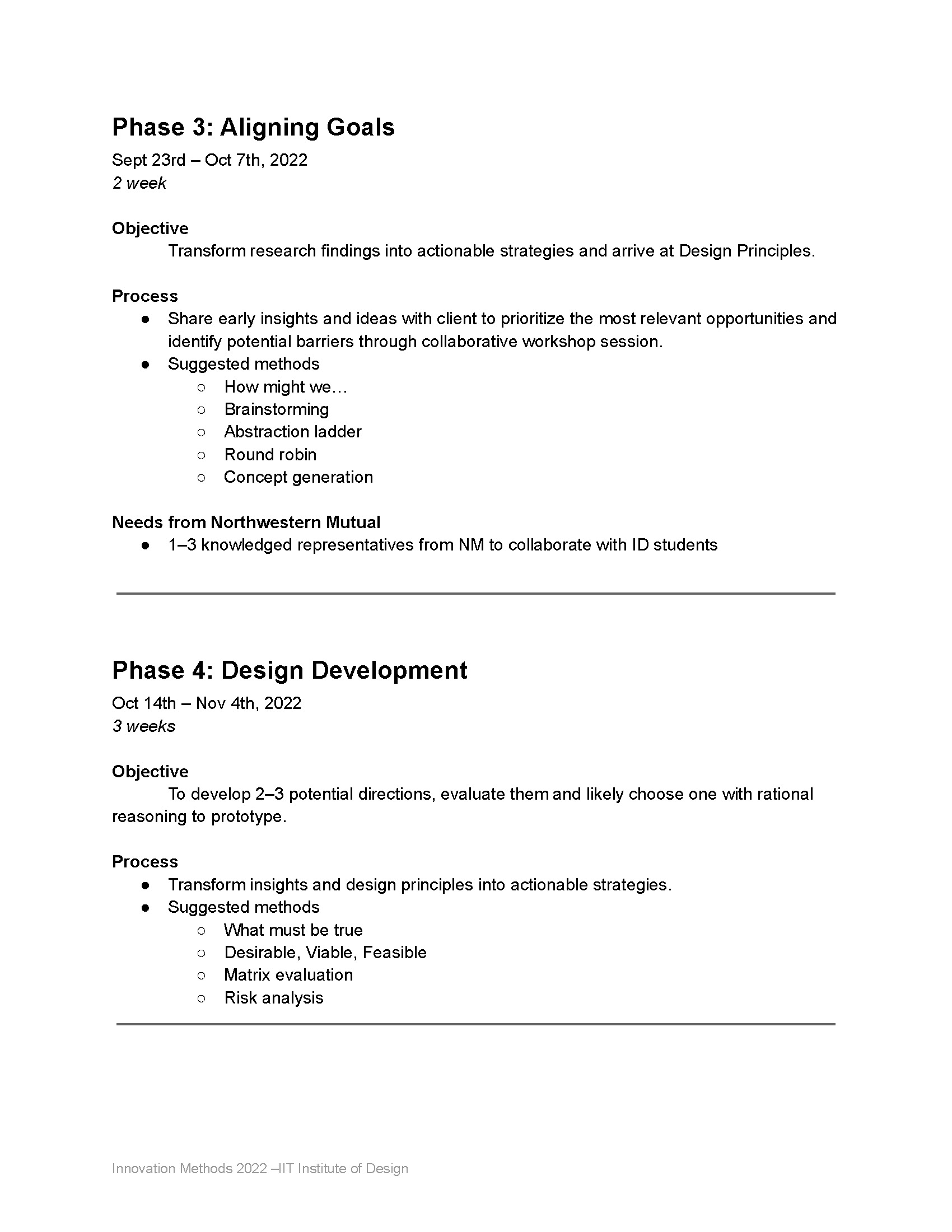

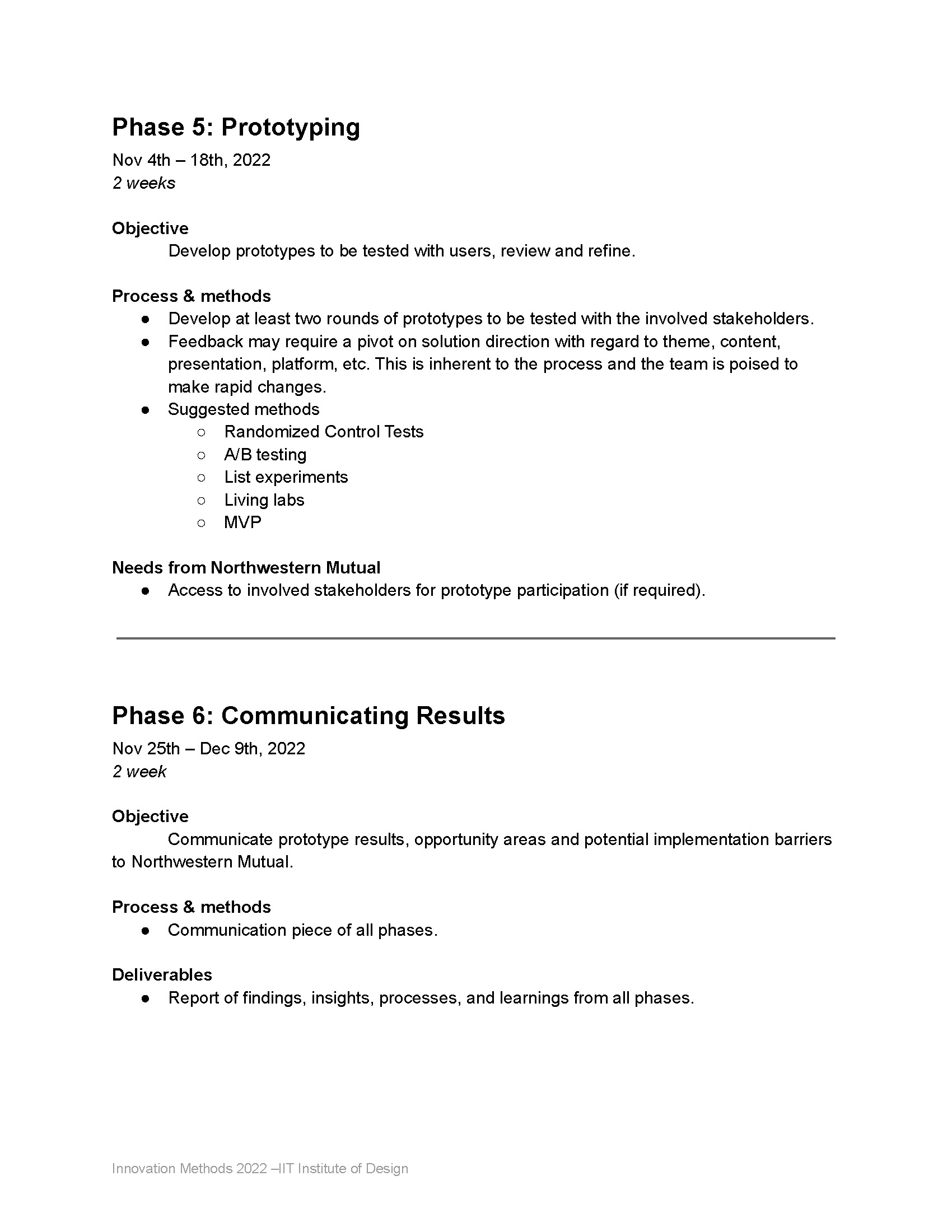

This initial research plan was created to set expectations with stakeholders NWM for the project timeline.

Process

The sprint began with ambiguity as we were introduced to the work with minimum direction to structure and progress. We set short-term goals as we started the work and fixed on crucial milestones, yet being agile to achieve holistic growth through our weekly progress.

Understand

With limited information from our client, the team began exploring NWM’s business goals, their clients, and their FR network to map out the Client–FR relationship. Informed by Casual Logics, the potential of AI and lifestyle trends was examined through case studies and credible white papers reports.

Realize

One of the early team activities was to familiarize ourselves with NWM’s desires, strengths, and capabilities, both internally within the organization and externally in the industry. The team listed the possible terrains, territories, and trails within our scope of action. Crucially, we also listed common orthodoxies in NWM and in the insurance industry.

Terrains, Terriroties and Trails informed by initial study of Northwestern Mutual and the financial services industry in the United States.

Analyse

The next phase in our work was to further deepen our knowledge of the industry and organization by interviewing the client’s representative. Exploring compelling applications of AI across various industries expanded our potential for novel ideas. Insights from our previous case studies and trends were further refined to reveal usable insights.

Synthesize

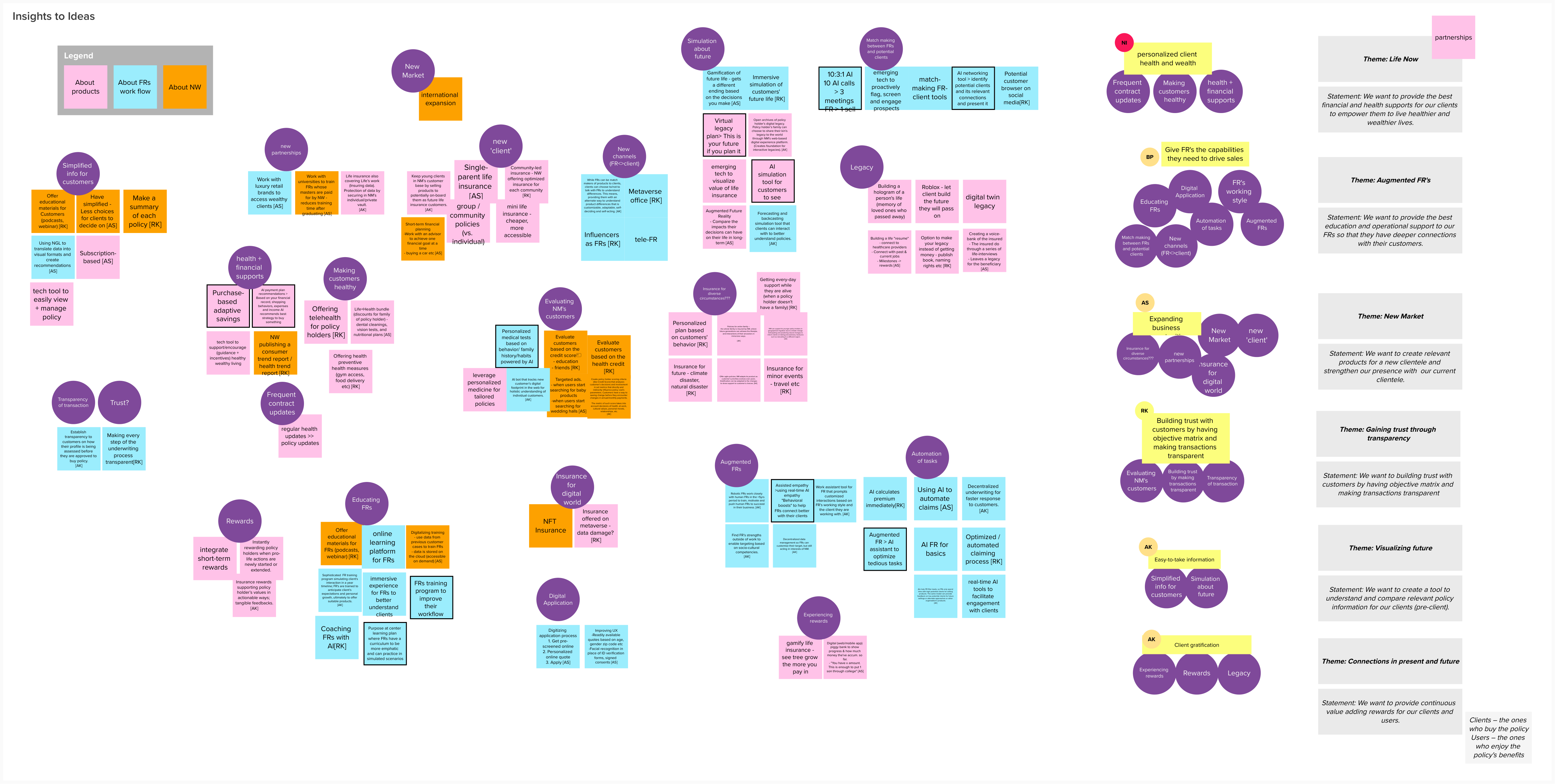

With new information being added to our Mural every day, the team began to make sense of all the collected data. Refining the core message from each source, actionable insights were developed, categorizing them into three buckets: Insurance products, FR’s workflow, and NWM’s processes. 100+ ideas were then bucketed with overarching themes. Further statements were crafted for each theme, explaining the desired actions for implementing innovation.

Concepts clustered by themes.

Develop

Themes were further prioritized and refined to develop concepts as part of a design sprint. Eight prominent and distinctive themes emerged. Only the themes relevant to the Client–FR experience were communicated to the client as the final selection deliverable.

Communicate

Four concepts needed to be communicated for actionable outcomes—finding a compelling way to convey these concepts was essential. Among many physical and digital options, videos proved to be the most effective channel for inviting participation from the NWM community. High-fidelity prototypes were created to assist with storyboarding. Feedback surveys are linked to each video to gather feedback from within the organization.

Outcomes

Experience 1

Automating the underwriting process with AI

With AI-enabled mobile and tablet applications, the underwriting process of life insurance policies becomes more efficient as the AI automatically calculates premiums tailored to each customer based on their lifestyle and health. To speed up authorizations, customers can authorize documents and verify their identities via Face ID on their smartphones.

Experience 2

AI-enabled client engagement through partnership with relevant services

By partnering with lifestyle services such as gyms, or yoga studios, customers are encouraged to keep a healthy lifestyle. For each action taken to improve their health, Northwestern Mutual customers will earn points which can be exchanged for lower premiums.

Experience 3

AI-enabled real-time assistance in client conversations

By partnering with lifestyle services such as gyms, or yoga studios, customers are encouraged to keep a healthy lifestyle. For each action taken to improve their health, Northwestern Mutual customers will earn points which can be exchanged for lower premiums.

Experience 4

AI-enabled on-the-job training for FRs

AI will be used to replicate real and past conversations between FRs and clients to help FRs improve and attract newer clients more efficiently.

Impact

The quality of outcomes and rapid progress in the span of 14 weeks came as a surprise to our stakeholders at NWM. Upon communicating the work to the broader organization, NWM has since increased the adoption of design practices in their everyday work. The outcome also served as a key reason to establish a Design Thinking Academy at Northwestern Mutual.

“The quality of your work is on par with the of top consulting firms. Several departments within the company would immensely benefit from this.”

— Senior Director, Enterprise Experience Design, Northwestern Mutual